Navigating the Fog of War: Immediate Impact on Indian Equities from an Ongoing India-Pakistan Conflict

A Deep Dive into Historical Patterns, Real-Time Risks, and Strategic Outlooks for Indian Equities During Wartime Uncertainty

Preface

This report, has been largely generated with the assistance of advanced AI research tools and frameworks. It represents a rigorous attempt to synthesize historical data, scenario modelling, and current market signals to evaluate the likely impact of geopolitical tensions on Indian equities.

Important Disclaimer:

This document is not financial or investment advice. The information contained herein is purely for educational and informational purposes. It should not be construed as a recommendation to buy, sell, or hold any financial instruments or securities. All investment decisions must be made with proper due diligence, personal financial analysis, and consultation with a licensed advisor. The views and interpretations herein are speculative and subject to change based on emerging data and events.

Author's Note

While this research is largely done with AI, as someone closely observing the geopolitical and financial landscape, I would like to offer a personal reflection. Based on developments up to May 9, 2025, a short-term panic sell-off in Indian equities seems highly likely, driven by fear and uncertainty. However, I believe India’s evolving response—marked by transparency, strategic clarity, and institutional resilience—positions the country to emerge stronger both economically and politically.

This is not the first time India has faced adversity, and history shows that it is precisely in such moments that enduring opportunities are born. In my view, for those who trust in India's structural growth story and long-term potential, this turbulent period may well become a defining moment—a time when standing by the nation could yield profound rewards in the future.

— Anand Bhaskaran

May 9, 2025

I. Executive Summary: Immediate Outlook for Indian Equities Amidst an Ongoing India-Pakistan War

An ongoing India-Pakistan war is anticipated to trigger an initial, sharp negative reaction in Indian equity markets, namely the Sensex and Nifty, within the first one to three trading days. This immediate downturn would be primarily fueled by heightened uncertainty and a consequent flight to safety among investors. A significant spike in the India VIX, the market's volatility index or "fear gauge," is expected, reflecting increased nervousness and perceived risk in the financial system.1

Historical precedents from similar geopolitical flare-ups suggest that such market dips in India are often short-lived. A recovery typically commences within a few days to a week, contingent upon the conflict's scope being perceived as limited and not escalating uncontrollably into a wider, more protracted engagement.3

Investor behavior is likely to be characterized by immediate caution across all classes. Retail investors and some High-Net-worth Individuals (HNIs) might react with panic selling in the initial days.5 However, Domestic Institutional Investors (DIIs) are expected to act as a counter-balancing force, potentially absorbing some of the sell-off. Foreign Institutional Investors (FIIs), based on past behavior, have demonstrated resilience, often viewing such geopolitical events as transitory shocks unless India's macroeconomic fundamentals are severely threatened.4

In terms of sectoral shifts, a flight to safety towards large-cap, high-quality stocks and traditionally defensive sectors such as Fast-Moving Consumer Goods (FMCG), Pharmaceuticals, and Information Technology (IT) is probable in the immediate term.8 Stocks related to the defence sector might also experience speculative interest.

The depth and duration of the market impact will critically depend on the perceived scale, intensity, and potential duration of the war, the nature and extent of international involvement, and the clarity and credibility of communication from authorities on both sides. A scenario perceived by the market as a full-blown, protracted war would invariably have a more severe and lasting negative impact than a conflict that is, or is perceived to be, limited and contained.

II. Contextualizing the "Ongoing War": Assumptions and Market Perception

For the purpose of this analysis, an "ongoing India-Pakistan war" is assumed to be a state of active, declared, or undeclared military conflict that surpasses the scale of recent limited skirmishes or surgical strikes, such as the 2019 Balakot airstrikes or the more recent, hypothetically referenced "Operation Sindoor." The market's reaction is profoundly influenced by its perception of the conflict's potential to escalate, disrupt broader economic stability, and alter the geopolitical landscape.

The "Uncertainty Premium"

Financial markets inherently dislike uncertainty. An "ongoing war" signifies a period of sustained ambiguity regarding the conflict's trajectory, potential economic damage, human cost, and eventual geopolitical realignments. This pervasive uncertainty commands a risk premium, prompting an immediate de-risking posture among investors.3 The term "ongoing war" itself suggests a more significant and potentially prolonged event compared to operations like "Operation Sindoor," which was characterized in reports as "precise and restrained" and "non-escalatory".3 The Indian market's relatively swift recovery following "Operation Sindoor" was largely attributed to this perception of limited scope. An "ongoing war," particularly in its initial days when information is scarce and often contradictory, would unlikely be perceived with similar equanimity. The initial information vacuum or conflicting reports during the early days of a war will invariably exacerbate market volatility, as investors struggle to price in the unknown.

Scale and Duration as Key Determinants

The immediate market reaction will be continuously calibrated based on the incoming news flow regarding the war's intensity, geographical spread, and the types of military assets involved. Initial reports suggesting a large-scale, multi-front engagement, or the potential for the use of more destructive weaponry, would trigger a significantly more severe market downturn than if the conflict, despite being termed a "war," appears localized and conventional in nature.

The market's interpretation of the term "war" is, therefore, crucial. A conflict that, in its initial presentation, resembles the 1999 Kargil War (which, while serious, was geographically contained and fought with conventional means) might elicit a different, possibly less severe, initial panic than a "war" that carries broader strategic implications or raises fears of unconventional escalation. The more ambiguous and threatening the initial news flow, the sharper the anticipated market decline will be. This is because rational investment decisions become difficult when the range of potential outcomes is excessively wide and includes catastrophic scenarios.

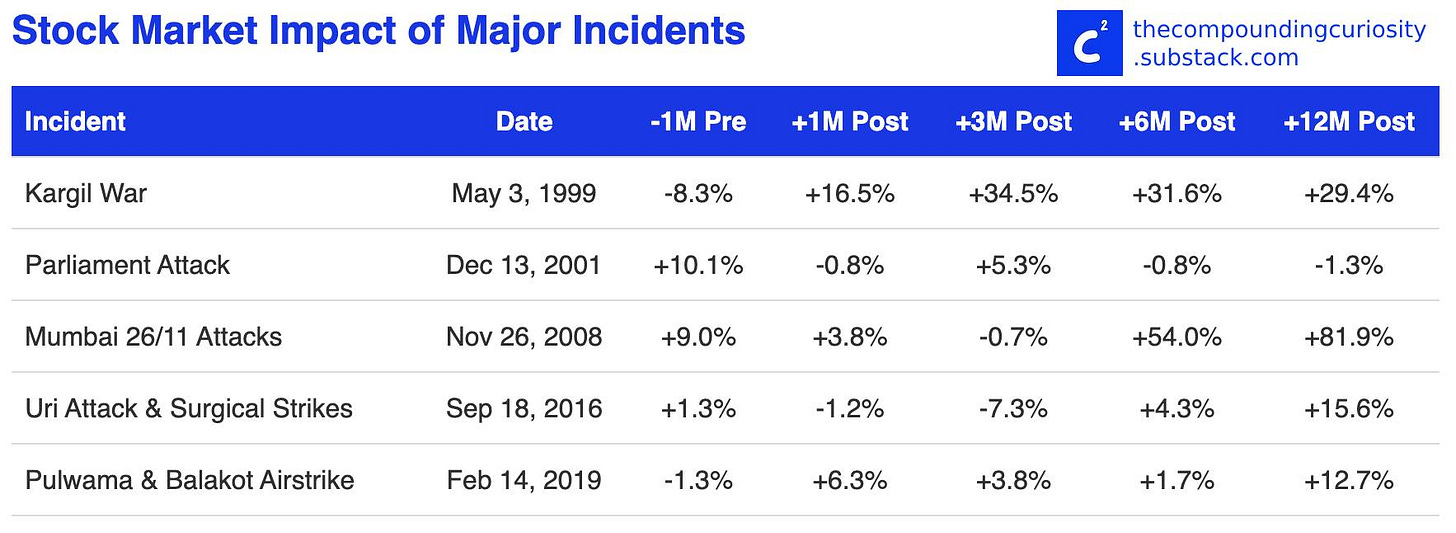

III. Historical Precedents: Indian Market Behavior in Past Indo-Pak Conflicts

Examining past instances of conflict and heightened tension between India and Pakistan provides valuable context for anticipating immediate market reactions. The focus here is on the initial percentage dips in benchmark indices (Sensex/Nifty) and the speed of any nascent recovery within the first few days or week of the event.

A. Kargil War (May-July 1999)

While the overall period of the Kargil War famously saw the Sensex gain significantly (37% between May 3 and July 26, 1999 10), the immediate run-up and initial phase were marked by nervousness. Reports indicate that the Nifty 50 plunged by 16% in early April 1999 as news of Pakistani infiltrations began to emerge, suggesting that markets started pricing in conflict risk well before the official commencement of large-scale operations.9 One source mentioned the market dropped by 8.3% one month before the war began.11 During the conflict itself, there was a brief but sharp correction between May 20 and May 28, 1999, where the Sensex fell by 12.5%, though these losses were quickly reversed.10 Some analyses suggest a maximum drawdown for the Nifty of only -0.80% during the war period, which likely refers to net movement over a specific phase rather than the initial shock or pre-war jitters.12

The Kargil experience is somewhat unique in that the market rallied substantially during the war. This suggests that once the conflict began and India demonstrated military resolve and a clear path to success, optimism returned, possibly fueled by a sense of "relief over clarity" and positive "military momentum".9 However, for an "ongoing war" scenario where the outcome is uncertain in the initial days, the pre-war slump and the mid-May 1999 correction are more pertinent indicators of potential initial shock. If an "ongoing war" scenario is preceded by a period of rising tensions and an associated market correction, the actual outbreak might see a "sell the rumor, buy the news" type of reaction, if India is perceived to be responding effectively and the conflict appears containable. Conversely, a surprise outbreak of war would likely lead to a sharp initial dip as the market absorbs the new reality.

B. Parliament Attack (December 13, 2001) & Subsequent Standoff

The terrorist attack on the Indian Parliament in December 2001, and the subsequent prolonged military standoff known as Operation Parakram, saw a sharper initial market drop and a more sustained negative impact. While some sources indicate a Nifty fall of -0.8% one month after the attack 4, this does not capture the immediate shock. Other analyses point to a 3% Sensex correction during the Parliament Attack episode.7 A more extended view shows the Nifty falling by as much as 13.9% between December 13, 2001, and October 1, 2002.3 This extended downturn was also influenced by significant global headwinds, including the aftermath of the 9/11 attacks and the bursting of the dot-com bubble, with the S&P 500 declining substantially during the same period.13 This highlights that the duration of a crisis and the prevailing global economic context are critical factors influencing market recovery.

C. Mumbai 26/11 Attacks (November 26-29, 2008)

The market reaction to the Mumbai terror attacks was surprisingly resilient, especially considering the event's severity. The Sensex reportedly climbed by around 400 points, and the Nifty gained 100 points during the two days of the attacks.3 One month later, the Nifty showed a positive return of 3.8%.4 On November 28, 2008, the Sensex opened lower but closed 0.73% higher.5 This resilience must be viewed in the context of the ongoing Global Financial Crisis, which was the dominant negative force at the time. The market's ability to look past this specific terror event (which was not a direct state-on-state military conflict) might suggest that when larger global crises are unfolding, the incremental impact of a localized, albeit horrific, terror event on broad market indices might be less pronounced, though specific sectors like hotels were severely impacted.5

D. Uri Attack & Surgical Strikes (September 2016)

Following the Uri terror attack and India's subsequent surgical strikes, the market reaction was negative but relatively contained. Reports indicate the market fell by over 2% between September 18 and September 26, 2016.3 Post-surgical strikes, the market was down 1.76%, though it was noted to be already in a broader downtrend.8 One month after the event, the Nifty had fallen by 1.2% 4, with an overall market dip of 2.1% between September 18-29, 2016.13 The surgical strikes were a swift, retaliatory action. The market reacted to the initial uncertainty but appeared to stabilize once the operation was concluded and perceived as successful without immediate further escalation from the opposing side.

E. Pulwama Attack & Balakot Airstrikes (February 2019)

This period also saw a mild initial dip followed by a quick recovery. After the Pulwama attack, the Nifty fell just 0.2% the next day. It dipped again after the Balakot airstrikes but then resumed its uptrend.8 Overall, indices dropped by more than 1.8% between February 14 and March 1, 2019. On February 26, 2019 (the day of the Balakot strikes), the Sensex plunged 1.38% and the Nifty 0.41%; however, the Sensex recovered by 5% over the subsequent three sessions.5 Other reports confirm a Sensex fall of 239 points and a Nifty loss of 44 points immediately post-Balakot, with a recovery the very next day.6 The maximum drawdown for the Nifty during this period was recorded at -1.80%.12 Similar to the Uri strikes, the Balakot event was a precise military action. The market exhibited initial nervousness but recovered swiftly as fears of a wider escalation subsided. The perceived limited nature of the engagement was key to this rapid stabilization.

The following table summarizes the initial market reactions:

Table 1: Comparative Market Performance (Sensex/Nifty) During Initial Days of Key Indo-Pak Conflicts

Note: Exact daily data for very early conflicts can be difficult to pinpoint precisely from aggregated reports. The table aims to capture the immediate shock. The variability in these reactions underscores that while an initial dip is common, its magnitude and immediate aftermath are highly event-specific.

IV. Lessons from "Operation Sindoor": A Recent (Hypothetical) Case Study

The research material frequently refers to "Operation Sindoor" as a very recent military action undertaken by India around May 6th or 7th, 2025.3 Analyzing the reported market reaction to this event provides a template for understanding how markets might process a swift, retaliatory, and purportedly "non-escalatory" military engagement.

On May 6th (Tuesday), described as a day of pre-emptive jitters or the day of the operation, the BSE Sensex closed 155 points lower, and the Nifty-50 ended down by 81 points. The broader market experienced more significant declines, with the Nifty Midcap 150 and Nifty Smallcap 250 slumping by 2% and 2.2%, respectively.10 Following this, on May 7th (Wednesday), as news of the operation became widespread, the Sensex opened approximately 692 points lower, and the Nifty gapped down by around 146 points. However, both benchmark indices recovered their losses with remarkable speed. The Sensex was reported to have even risen over 200 points from its previous close before settling to trade flat or slightly down, while the Nifty also pared its opening losses swiftly.3

Crucially, "Operation Sindoor" was consistently described by analysts and in reports as "precise and restrained," "designed to be non-escalatory in nature," and specifically targeting "known terror camps" while avoiding Pakistani civilian, economic, or military targets.3 This official messaging and subsequent interpretation by market experts appear to have been pivotal in shaping the market's response. Several analysts noted that the market was unlikely to be significantly impacted in a sustained manner because a retaliatory strike by India was "known and discounted" by market participants in the run-up to the event.3 VK Vijayakumar of Geojit Investments highlighted the "focused and non-escalatory nature" of the operation as a key reason for the market's stability.3 Abhishek Jaiswal of Finavenue opined that the reaction was in line with historical trends and that, as long as a full-blown escalation is avoided, India's economic growth is unlikely to face major setbacks.4 Similarly, Anirudh Garg of Invasset PMS stated that while military actions cause short-term sharp reactions due to uncertainty, markets often recover swiftly if broader macroeconomic fundamentals remain intact.4

The market's behavior during "Operation Sindoor" underscores two critical considerations for any "ongoing war" scenario. Firstly, the "discounting" effect: if an "ongoing war" commences with actions that are perceived by the market as part of a familiar, albeit escalated, pattern of conflict and retaliation, the market might have already partially priced in such a possibility, especially if geopolitical tensions were visibly rising beforehand. The "known and discounted" aspect is therefore significant. Secondly, the "value of clarity and perceived control": the rapid recovery post-"Operation Sindoor" was intrinsically linked to the perception that the operation was controlled, limited in scope, and intentionally non-escalatory. If an "ongoing war" lacks this perceived control or clarity of objectives in its initial days, the negative market impact will likely be more severe and sustained. Consequently, official communication from the government that emphasizes clear, limited objectives and demonstrable control over the escalation ladder could play a vital role in mitigating market panic. The information environment and perception management during the first few days of a war are as crucial as the military actions themselves in shaping immediate market sentiment.

V. Anticipated Immediate Market Dynamics (Next Few Days of an "Ongoing War")

Synthesizing historical data from past conflicts and observations from more recent events like "Operation Sindoor," the following market dynamics are anticipated in the immediate few days of a new, ongoing India-Pakistan war.

A. Index Trajectory (Sensex & Nifty)

An initial, sharp sell-off is highly probable. Benchmark indices like the Sensex and Nifty are likely to experience a gap-down opening on the first trading day after the "ongoing war" status becomes clear, followed by further selling pressure in the first one to two days. The magnitude of this initial dip could range from an average of 3-5%, drawing parallels from milder past events like the Uri/Pulwama incidents.3 However, if the initial reports about the war are particularly alarming, suggesting a large-scale, uncontrolled escalation, or significant early setbacks, the decline could potentially reach 7-10% or even more. This higher range is informed by the average 7.5% dip observed at the lowest points across eleven varied incidents of Indo-Pak tension.4

Markets will then attempt to find a bottom, typically within two to five trading days, a process heavily influenced by the continuous flow of news from the conflict zone. Signs of de-escalation, reports of limited engagement, or clear indications of effective Indian military control could facilitate a quicker bottoming process.3 Conversely, news of significant escalation, heavy casualties, or a widening of the conflict theatre would prolong the downturn and delay the formation of a market bottom.

B. Volatility Surge (India VIX)

A sharp and immediate spike in the India VIX, the market's primary gauge of expected volatility, is anticipated. The VIX could surge by 20-50%, or potentially more, from its pre-conflict baseline within the first few days of the war.1 Historical data for the India VIX, particularly post-2008/2009 when it became more established, shows its sensitivity to geopolitical stress. For instance, during February 2019 (coinciding with the Pulwama attack and Balakot airstrikes), the VIX registered a monthly increase of 6.75%.15 More dramatically, hypothetical data for May 2024 in one source showed the VIX up 91.14% monthly, and for April 2025, up 43.24% monthly, illustrating its potential to react strongly to periods of high uncertainty.15 The VIX is likely to remain at elevated levels as long as acute uncertainty about the war's trajectory persists, indicating a higher premium for options contracts and reflecting general market nervousness.

Table 2: India VIX Movements During Initial Days of Geopolitical Stress (Illustrative based on available data patterns)

Note: Precise daily VIX changes directly correlated to the exact start of older conflicts are not readily available in the snippets. The table illustrates general VIX reactivity based on provided data patterns during stress periods.

C. Investor Sentiment and Capital Flows

Immediate reactions are expected across investor categories.

Retail/HNI: This segment is prone to panic selling in the initial days, potentially leading to a flight to cash or perceived safe-haven assets like gold or government securities.5 Media narratives and social media sentiment will heavily influence their actions.9

DIIs (Domestic Institutional Investors): DIIs, including mutual funds and insurance companies, are likely to step in as buyers, especially if valuations become attractive due to panic-driven sell-offs by other segments. They often act as a counter-balancing force, providing a crucial cushion to the market and preventing a free fall.6

FIIs (Foreign Institutional Investors): Historically, FIIs have not resorted to large-scale panic selling during past Indo-Pak conflicts, often maintaining a net positive or stable stance. They tend to view these events as transitory shocks, provided India's long-term economic growth story and policy stability remain intact.4 For instance, FII inflows were reportedly strong in March 2019, following the Pulwama/Balakot events.17 However, an "ongoing war" scenario, being more severe, might see FIIs adopt a "wait-and-see" approach in the initial days. This could translate to reduced inflows or marginal outflows until greater clarity on the conflict's scope and potential economic impact emerges. A sustained, large-scale conflict that threatens macroeconomic stability could, of course, alter this historically resilient behavior.18

The growing size and influence of DIIs in the Indian market provide a more significant domestic buffer against potential FII selling pressure than was the case in earlier conflicts like the 1999 Kargil War, when FII stakes were negligible.9 FIIs, in the current context, will likely be highly selective, carefully differentiating between a limited, containable conflict and one that poses a genuine threat to India's broader macroeconomic stability or policy continuity. While FIIs might pause or exhibit marginal outflows initially, DIIs could absorb some of this selling pressure. The ultimate decision for FIIs to stay invested or reduce exposure will hinge on the war's perceived impact on India's long-term growth trajectory, rather than solely on the conflict itself.

Table 3: FII/DII Net Investment Trends (Equity Cash Market) in the First Week of Key Past Conflicts (Illustrative)

Given the available data around the "Operation Sindoor" period (early May 2025):

May 2, 2025: FII Net Buy ₹2,769.80 Cr; DII Net Buy ₹3,290.49 Cr 16

May 5, 2025 (Monday, pre-Operation Sindoor announcement): FII Net Buy ₹497.80 Cr; DII Net Buy ₹2,788.66 Cr 16

May 6, 2025 (Tuesday, Operation Sindoor news/jitters): FII Net Buy ₹3,794.50 Cr; DII Net Sell ₹1,397.68 Cr 21

May 7, 2025 (Wednesday, post-Operation Sindoor confirmation): FII Net Buy ₹2,585.90 Cr; DII Net Buy ₹2,378.49 Cr 21

This recent pattern around "Operation Sindoor" suggests FIIs remained net buyers, and DIIs also largely provided support, which aligns with the narrative of a discounted, non-escalatory event. An "ongoing war" might test this pattern more severely.

D. Key Sectoral Impacts (Immediate Term)

Negative Impact (Higher Beta, Discretionary, Credit Sensitive): Sectors such as Realty, Mid-caps, and Small-caps are likely to witness sharper declines due to heightened risk aversion.8 Businesses reliant on discretionary consumer spending, such as non-essential retail, and sectors like tourism and aviation, which are directly impacted by travel restrictions and fear psychosis, would also face significant headwinds.7 Financials, particularly Non-Banking Financial Companies (NBFCs) or banks with higher perceived credit risk exposure, might see increased caution due to fears of an economic slowdown impacting loan repayments. However, high-quality, well-capitalized large-cap banks have often shown resilience.8

Resilient/Defensive (Lower Beta, Non-Discretionary, Quality):

Large-caps: Generally, these stocks are preferred for their relative stability and liquidity during times of crisis.8

FMCG & Pharmaceuticals (Healthcare): These sectors are traditionally considered defensive due to the inelastic demand for essential goods and healthcare services, making them less susceptible to immediate economic shocks.5

IT Sector: The Indian IT sector, being largely export-oriented, is often seen as relatively insulated from domestic turmoil. Its performance would also depend on global macroeconomic conditions and currency movements, but it typically offers a defensive hedge.5

Speculative Interest:

Defence Stocks: Companies in the defence manufacturing and allied sectors may see a short-term speculative rally. This would be driven by sentiment and expectations of increased government procurement and a heightened focus on national security, although their fundamental business prospects may not change immediately.7

In the immediate aftermath of an "ongoing war" announcement, a pronounced "quality tilt" is expected, with investors favoring established large-cap companies with strong balance sheets and defensive characteristics. The speculative interest in defence stocks is often sentiment-driven and can be short-lived. A prolonged war could introduce complexities, such as straining government finances, which might eventually temper enthusiasm for defence stocks if not backed by tangible, long-term order book increases. However, focusing on the "next few days," the initial flight to quality and some speculative buying in defence are the more probable sectoral reactions.

VI. Key External Variables in the Short Term (Next Few Days)

The Indian stock market's reaction will not occur in a vacuum. Several external variables will play a crucial role in shaping sentiment and market movements in the immediate days following the outbreak of an ongoing war.

A. Global Crude Oil Prices

India is a major importer of crude oil, and its economy is highly sensitive to fluctuations in global oil prices. A significant spike in crude oil prices resulting from the conflict—either due to perceived threats to regional supply lines, shipping routes, or a broader geopolitical risk premium—would be a major negative for India.9 Such a spike could exacerbate domestic inflation concerns, widen the Current Account Deficit (CAD), and negatively impact corporate profitability for energy-intensive sectors, thereby further dampening overall market sentiment. In the next few days, the market will react sharply to any indicative moves in Brent crude futures. A jump above a key psychological threshold (for instance, $100 per barrel, depending on prevailing prices at the time of conflict) would be a clear and immediate negative catalyst. Even if physical supply isn't immediately disrupted, a "fear premium" can rapidly get built into oil prices due to the conflict's geographical proximity to major energy corridors or producing regions in the broader Middle East. This psychological impact on oil prices can be swift and significant.

B. USD/INR Exchange Rate

Increased geopolitical risk in the region typically leads to capital outflows from emerging markets or a broader flight to the safety of assets like the US dollar. This dynamic can put immediate depreciation pressure on the Indian Rupee (INR).1 A rapidly weakening INR can further unnerve foreign investors, raising concerns about imported inflation and the real returns on their Indian investments.23 While the Reserve Bank of India (RBI) would likely intervene in the foreign exchange market to curb excessive volatility and prevent a disorderly depreciation of the rupee, some downward pressure on the currency is to be expected. The USD/INR exchange rate will be closely watched as an immediate barometer of perceived risk. Sharp depreciation would signal heightened FII concern and could trigger broader market selling. The relative stability of the rupee during the 2019 Pulwama/Balakot incident was a positive factor 18, but an "ongoing war" represents a more severe scenario, likely exerting more intense pressure on the currency in its initial days.

C. Global Market Sentiment

The reaction of global financial markets will also significantly influence Indian equities. If global markets are already weak or exhibiting a strong risk-averse stance due to other contemporaneous global factors (e.g., concerns about global recession, other geopolitical tensions, or monetary policy tightening in major economies), the sell-off in the Indian market could be amplified.24 The correction during the 2001 Parliament attack, for instance, coincided with a significant decline in the S&P 500.13 Conversely, if global markets are stable or strong, it might provide some psychological support or lead to a quicker perception of the Indo-Pak conflict as an isolated issue, potentially moderating the domestic sell-off. However, in the immediate "ongoing war" phase, it is more likely that global risk aversion would increase, adding to the pressure on Indian equities. Any narrative of India's "relative stability" would only emerge much later, contingent upon a swift and favorable resolution of the conflict.

VII. Critical Risks and Market Sensitivities for the Coming Days

In the highly fluid initial days of an ongoing war, the market will be acutely sensitive to several critical risk factors.

A. Escalation vs. Containment

This is unequivocally the single most critical factor. Any news or credible intelligence suggesting that the conflict is spreading geographically, involving other state or non-state actors, intensifying in terms of weaponry used, or escalating towards unconventional (e.g., nuclear) threats would lead to severe market panic and a crash that could override historical patterns of quick recovery observed in limited conflicts. Conversely, credible information about efforts towards containment, ceasefire negotiations, or clearly defined and limited military objectives would be crucial in helping to stabilize market sentiment.

B. Official Communications and Media Narratives

The clarity, credibility, and consistency of official communications from both the Indian and Pakistani governments, as well as statements from influential international bodies (like the UN), will be paramount. Conflicting official reports, a lack of transparent information, or nationalistic rhetoric from either side that fuels jingoism and escalates tensions can exacerbate market panic.9 Markets will be highly sensitive to press briefings, official statements, and verified news reports, attempting to discern the true scale and trajectory of the conflict. Misinformation or disinformation could also play a disruptive role.

C. Duration of Intense Conflict

If the "ongoing war" translates into intense, widespread fighting that persists for more than a few days without a clear path towards de-escalation or a stabilization of fronts, the initial market shock could deepen and become more prolonged. Financial markets can generally absorb short, sharp shocks more effectively than sustained periods of high uncertainty and attritional warfare.

D. International Response

Statements and diplomatic actions from major global powers (such as the United States, China, Russia) and international organizations will be closely monitored. Calls for restraint, offers of mediation, or unified international pressure to de-escalate could calm nerves. Conversely, if international responses are perceived as weak, divided, or ineffective, it could increase uncertainty about the conflict's potential duration and outcome.

Beyond sentiment, a critical operational market risk during the initial, highly uncertain days of a war is the potential for liquidity to dry up. This "fog of war" impact can lead market makers and participants to become extremely risk-averse. Buyers may withdraw from the market, or significantly lower their bid prices, while sellers may become more desperate to offload positions. This can result in a substantial widening of bid-ask spreads, particularly for mid-cap and small-cap stocks, and a general reduction in trading volumes for those attempting to sell. Such illiquidity can exacerbate price declines, as even relatively small sell orders can have an outsized impact on prices. Circuit breakers on indices or individual stocks might also be triggered more frequently, temporarily halting trading but also highlighting the extent of market stress.

VIII. Strategic Considerations for Investors in the Immediate Term (Next Few Days)

Given the anticipated volatility and uncertainty, investors should consider the following strategic approaches in the immediate days of an ongoing India-Pakistan war:

A. Avoid Panic Selling

Historical data from past geopolitical shocks in India strongly suggests that markets tend to overreact to negative news in the short term, and panic selling during such events often leads to investors missing out on subsequent recoveries.3 Selling into a panic-driven dip can lock in losses just before a potential market stabilization or rebound.5

B. Focus on Quality and Large-Caps

In times of heightened uncertainty, investment capital tends to flow towards well-managed companies with strong balance sheets, proven and resilient business models, and dominant market positions. These characteristics are typically found in the large-cap segment of the market, which also offers better liquidity.8

C. Consider Defensive Sectors

Sectors such as FMCG, Pharmaceuticals (Healthcare), and IT may offer relative protection. FMCG and Pharma benefit from relatively inelastic demand for their products and services, while the IT sector's export orientation can insulate it to some extent from the immediate domestic economic fallout of the conflict, though it remains subject to global demand and currency fluctuations.5

D. Staggered Buying if Confident in Long-Term Resilience

For investors with a long-term investment horizon and a fundamental belief in the Indian economy's underlying strength and growth potential, sharp market dips driven by geopolitical fear can present opportunities to acquire quality stocks at more attractive valuations.5 Adopting a staggered buying approach—investing in tranches over a period rather than all at once—can help mitigate the risk of incorrectly timing the market's exact bottom.

E. Monitor News Flow Closely

Investors should stay updated with credible and verified news sources regarding the conflict's developments, official communications from the government, and international reactions. The situation can evolve rapidly in the initial days, and market sentiment will be highly reactive to new information.

F. Assess Risk Appetite

It is crucial for investors to reassess their individual risk tolerance in the context of heightened market volatility. Those with a low-risk appetite or short-term financial goals might prefer to wait on the sidelines until greater clarity emerges or consider increasing their allocation to traditionally safer assets, such as gold or government securities.5

While historical data often shows V-shaped recoveries from geopolitical shocks, attempting to perfectly time the bottom of the 'V' is an extremely difficult and risky endeavor. For most investors, the more prudent strategy is less about timing the absolute market bottom and more about either riding out the volatility with a portfolio of high-quality investments (if their horizon permits) or strategically accumulating quality assets at lower prices if their long-term conviction in those assets and the broader market remains high. The "opportunity" in such situations lies in acquiring good assets at potentially discounted prices for the long term, not in engaging in speculative short-term trading on volatility, which is best left to professional traders with appropriate risk management tools. The primary "trap" to avoid is panic selling at or near the bottom of a sharp, fear-induced market decline.

IX. Conclusion

The immediate impact of an ongoing India-Pakistan war on the Indian stock market, within the next few days, is projected to be negative, characterized by a sharp initial sell-off in benchmark indices and a significant surge in volatility. Historical precedents indicate that while such knee-jerk reactions can be severe, with potential initial dips ranging from 3-5% to over 7-10% depending on the perceived severity, Indian markets have often demonstrated resilience with recoveries commencing within days or weeks, provided the conflict is perceived as limited and does not spiral into a protracted, economically debilitating engagement.

Investor sentiment will be fragile, with potential panic selling from retail segments, while DIIs are likely to provide some support. FIIs may adopt a cautious "wait-and-see" stance initially, their longer-term actions contingent on the war's impact on India's macroeconomic fundamentals. A flight to quality large-caps and defensive sectors like FMCG, Pharma, and IT is anticipated, with speculative interest possible in defence-related stocks.

The trajectory beyond the initial shock will be critically dependent on the war's perceived scale, duration, the nature of international responses, and, importantly, the clarity and credibility of official communications. External factors such as global crude oil prices, the USD/INR exchange rate, and overall global market sentiment will also exert significant influence. While short-term caution is warranted, a strategy of avoiding panic decisions, focusing on fundamental strengths, and assessing individual risk appetite will be key for investors navigating this challenging period.

Works cited

Indices end lower amid geopolitical jitters and Fed caution - Market Commentary, accessed May 8, 2025, https://www.icicidirect.com/equity/market-news-list/e/indices-end-lower-amid-geopolitical-jitters-and-fed-caution/1597604

Indian markets open: Sensex, Nifty likely to dip; focus shifts to geopolitical risk By Invezz, accessed May 8, 2025, https://in.investing.com/news/indian-markets-open-sensex-nifty-likely-to-dip-focus-shifts-to-geopolitical-risk-4817213

From Kargil to Operation Sindoor: How Indian markets have historically reacted after military strikes - Fortune India, accessed May 8, 2025, https://www.fortuneindia.com/markets/from-kargil-to-operation-sindoor-how-indian-markets-have-historically-reacted-after-military-strikes/122843

Operation Sindoor: How have stock markets reacted to India-Pak ..., accessed May 8, 2025, https://www.business-standard.com/markets/news/operation-sindoor-how-have-stock-markets-reacted-to-india-pak-war-in-past-125050700765_1.html

How Escalating India-Pakistan Tensions Could Impact the Stock ..., accessed May 8, 2025, https://www.torusdigital.com/toruscope/news/how-escalating-india-pakistan-tensions-could-impact-indias-stock-markets/

India's Market Resilience Seen After Past Indo-Pak Conflicts: Pahalgam Impact - NiftyTrader, accessed May 8, 2025, https://www.niftytrader.in/content/indias-market-resilience-seen-after-past-indo-pak-conflicts-pahalgam-impact/

India-Pak tensions: Why market isn't panicking and what investors should do, accessed May 8, 2025, https://www.business-standard.com/finance/personal-finance/india-pak-tensions-why-market-isn-t-panicking-and-what-investors-should-do-125050800199_1.html

Operation Sindoor: How the India-Pakistan conflict could impact Indian stock market? What should investors do? - Mint, accessed May 8, 2025, https://www.livemint.com/market/stock-market-news/operation-sindoor-how-the-india-pakistan-conflict-could-impact-indian-stock-market-what-should-investors-do-11746590187751.html

How did stock market perform during India vs Pakistan Kargil War? Will history repeat itself?, accessed May 8, 2025, https://tradebrains.in/how-did-stock-market-perform-during-india-vs-pakistan-kargil-war-will-history-repeat-itself/

Kargil War and Stock Market Recovery: When Sensex bounced back 37% defying 1999 conflict impact, Indo-Pak tensions | Zee Business, accessed May 8, 2025, https://www.zeebiz.com/market-news/news-kargil-war-and-stock-market-recovery-when-sensex-bounced-back-37-defying-1999-conflict-impact-indo-pak-tensions-359693

India-Pakistan conflict: How should mutual fund investors deal with geopolitical threats?, accessed May 8, 2025, https://m.economictimes.com/mf/analysis/india-pakistan-conflict-how-should-mutual-fund-investors-deal-with-geopolitical-threats/articleshow/120958050.cms

How Indo-Pak conflicts impact Nifty: Market reactions and recovery trends since Kargil War, accessed May 8, 2025, https://m.economictimes.com/markets/stocks/news/how-indo-pak-conflicts-impact-nifty-market-reactions-and-recovery-trends-since-kargil-war/pulwama-attack-and-balakot-airstrike-14/02/2019/slideshow/120956310.cms

India Market Correction In Times Of Conflict — In Chart - NDTV Profit, accessed May 8, 2025, https://www.ndtvprofit.com/markets/india-market-correction-in-times-of-conflict-in-chart

How Indo-Pak tensions have impacted Indian stock markets over the years | Zee Business, accessed May 8, 2025, https://www.zeebiz.com/india/news-how-indo-pak-tensions-have-impacted-indian-stock-markets-over-the-years-359858

India VIX Share Price History, Performance Analysis, and Returns Pattern - Trendlyne.com, accessed May 8, 2025, https://trendlyne.com/share-price/performance/178701/NIFTYVIX/india-vix/

FII & DII DATA: Buy/Sell Activity in Cash, F&O And Net - Equitypandit, accessed May 8, 2025, https://www.equitypandit.com/fii-dii-data/

Motilal Oswal Financial Services, accessed May 8, 2025, https://www.motilaloswal.com/site/rreports/html/636899645051107853/index.htm

India's appeal for investors dimmed but not derailed by conflict with Pakistan, accessed May 8, 2025, https://m.economictimes.com/markets/stocks/news/indias-appeal-for-investors-dimmed-but-not-derailed-by-conflict-with-pakistan/amp_articleshow/120983314.cms

Will rising Indo-Pak tensions dent foreign investment inflows to India? - India Today, accessed May 8, 2025, https://www.indiatoday.in/amp/business/market/story/india-pakistan-rising-tension-war-impact-on-economy-foreign-investments-2721404-2025-05-08

DII Investments | DII Trading Activity - Nirmal Bang, accessed May 8, 2025, https://www.nirmalbang.com/equity/dii-investments-trading-activity.aspx

Live FII & DII Trading Activity Daily, Monthly & Yearly | Research 360 by Motilal Oswal, accessed May 8, 2025, https://www.research360.in/fii-dii-data

FII DII Data based on activity on NSE, BSE - StockEdge Web, accessed May 8, 2025, https://web.stockedge.com/fii-activity

1 USD To INR: Tracking Historical Exchange Rate From 1947 To 2025 - Forbes India, accessed May 8, 2025, https://www.forbesindia.com/article/explainers/1-usd-to-inr-history/88635/1

Why trade tensions are a 'storm cloud' over financial markets | World Economic Forum, accessed May 8, 2025, https://www.weforum.org/stories/2025/04/tariffs-trade-tensions-storm-cloud-stocks-financial-markets/

How Global Events Influence Stock Market Volatility and Investor Behavior - Daily Emerald, accessed May 8, 2025, http://dailyemerald.com/164087/promotedposts/how-global-events-influence-stock-market-volatility-and-investor-behavior/